With interest rates being lower than they have been in a while and some real estate inventory that has been sitting…

There are buying opportunities!

The Gold Coast offers great condos at about $300+ per sq foot and Logan Square, Humboldt Park, Ravenswood, and even Lincoln Park see buying opportunities for first-time homebuyers.

Buying is a very smart choice under particular circumstances.

This market opportunity is great for someone who can hold for several years – if you can lease out the 2nd bedroom should you be single – this can be extremely beneficial.

A second scenario is newlyweds wanting to stay in the city and have a family: now is the time!

There are factors like better schools, easy access to public transportation, diverse, robust grocery shopping and cool, interesting restaurants that can enhance a homebuyers city experience.

Bike paths like the 606 Trail can also be an amenity when homeowners LOVE to walk or bike.

While these all point in a great direction – below are some funny stories and first-hand experience to consider before you buy.

With Spring around the corner…. happy learning and looking …. covering these bases BEFORE you buy CAN be helpful.

Cheers!

Randy

See the full Chicago Tribune article that I was quoted in about the things I wish I knew before buying below:

Surprises and mortgages from the ‘seventh circle of hell’: Things I wish I knew before buying my first home

There will be surprises. And hidden costs. And more paperwork than you ever thought one person could file in a lifetime. Oh, and it might take you a while to settle into this giant commitment you just spent your pretty pennies on.

Buying a home is a lot of things — easy it is not. Which is why a little knowledge from the pros and those who have been-there-done-that can go a long way.

We asked industry experts, everyday homeowners and our own reporters to offer words of wisdom — things they wish they had known before buying their first home.

There are always, always, surprises. No inspection catches everything. Count on something going wrong — a water heater that dies, roots growing into water lines — something will happen. You think you’re broke the day you close? You’re going to be more broke a month later. And if you can, refinish floors, replace carpet and repaint before moving. These are the most disruptive upgrades to do later because they disrupt entire rooms. It’s actually less disruptive to the household to remodel a kitchen or bathroom than to upend the entire living room to paint a year after you move in.

Combine deals at home improvement stores. Research in advance the best deals they offer on in-store credit cards, and ask when they have sales. Combine sales and credit offers to get the best possible prices on appliances, fixtures and materials.

If you have kids, line up baby-sitting for the day of the move and a day or two later. Plan a couple of unpacking/organizing shifts that let you park toxic, sharp or fragile items without worrying about protecting them from the kids or vice versa. And pack a suitcase for each child’s essentials, even if you’re just moving across town — think blankie, toiletries, spare clothes. Keep the suitcases in the car so you have everything you need for a first good night’s sleep. — Joanne Cleaver, freelance writer, real estate and personal finance

My first homebuying experience was simple from a purchase standpoint. I was young, pregnant with my first child and had a sense of what I wanted for a floor plan, square footage and design. But what stands out for me is that I had this fantasy of living in the suburbs, white picket fence and all. Shortly after I moved into my new suburban home, I realized I was much more of a city girl. In the western portion of Northbrook, I had to drive 5 miles to the grocery store. I couldn’t walk to a restaurant, a park or the train. Each buyer’s preferences are uniquely their own, but for me, a location that offered the daily conveniences, broad cultural experiences and diversity of urban living became top priority. So a few years later, we moved to Chicago — and we picked our neighborhood before choosing our house. — Gwen Farinella, real estate broker with Related Midwest Sales

“The hits never end on your loan and purchase,” said our mortgage broker the morning after our dry close on the first home my husband and I have purchased together. Exactly 15 months after our mortgage contract was approved to purchase a two-level condo in Chicago’s Kenwood neighborhood — and after four hours of signing, waiting, talking about eating rattlesnakes and guinea pigs, and more waiting — we were told the main bank was just one document short, and that maybe, just maybe, we’d get the keys the following day.

I wish we’d known that there was nothing short about a short sale, and ours was one for the record books, according to the attorneys and real estate agents. The seller had two loans on the property, which meant we needed the cooperation of two banks. If you are hoping to close on a short sale in a reasonable amount of time (30-90 days), you probably shouldn’t lock into a contract on a home that has more than one loan.

But our family of five — we have a college student and two teen boys — has needed more space for a while, and we wanted it in our same diverse, historic neighborhood. We knew that anything with four bedrooms would be pricey, so we started looking for deals. We landed on this beautiful, modern, well-kept short sale a block away from our current home.

“Everything that could go wrong did,” my husband said about the process. A lot of life happens in 15 months, but some things, like a home that fits your family, are worth the wait — if you have the patience and the time. — Rochell Sleets, Chicago Tribune deputy editor, life + culture

My experience was unique because I bought from a trust. I think it’s critical to have a professional relationship with your seller. If any additional “due diligence” type work comes up as part of the sale, you’ll need to make sure those lines of communication are open and both parties are aware of the necessary next steps. A strong relationship allows for any hiccups to be handled with minimal interference to the purchase process. Second, ensure whatever documentation provided by the seller is acceptable to your underwriters. If the documentation does not align with what your lender is asking for, it can cause a lot of rework between both parties. Finally, your lender has a lot of control over the purchasing process, so it’s imperative to be organized throughout the process and to have a good working relationship with them. — Jim Cullen, consultant

I purchased a condo around 1990, and I wish I’d learned more about the condition of the common spaces, as well as the nitty-gritty details of the actual unit’s condition. The previous owner had updated with fresh paint and new carpeting, so it was certainly move-in ready. But a few weeks later, I attended my first condo board meeting and learned that the 25-year-old buildings were in serious disrepair. The roofs were leaking, the sidewalks were crumbling, the courtyard was a swamp and the tennis court was unplayable because of deep fissures. I was heartbroken because I had sunk all my money into the down payment. For years, we had special assessments in the hundreds of dollars to fix everything. A year later, I ran for the board and ultimately became the president.

I wish I’d known about all the additional costs of simply living in my first condo after the real estate closing. The list included blinds for two windows and two sliding-glass balcony doors, a garage door opener, extra keys, locks for my laundry and storage room cubicles, floor mats, lightbulbs and more. I moved in at night, and the next morning when I got ready for work, I realized I didn’t have a shower curtain. I took a shower anyway and flooded the bathroom. My very first “new home” purchases that day were a shower curtain and bathroom rug. — Pamela McKuen, freelance writer, features

It takes a while to feel settled. Yes, this seems obvious. But after what seemed like a never-ending 90-day close and the marathon process of buying a condo, our light at the end of the tunnel was the celebratory feeling we were sure we’d experience when we moved in. Nope. Not at first. The first night in our new home just felt, quite simply, like a lot to do. Boxes everywhere to unpack, all kinds of appliances and flooring we now owned and were in charge of fixing should anything go wrong, a new neighborhood to search out the closest pizza place. Many wise people advised that it takes time to feel settled, and they were right. So don’t mistake first-night exhaustion for big-picture fears about making the wrong decision. Live in the space. See how it feels. Decide where you want things. But first, buy flowers and clear at least one room of boxes. — Alison Bowen, Chicago Tribune reporter

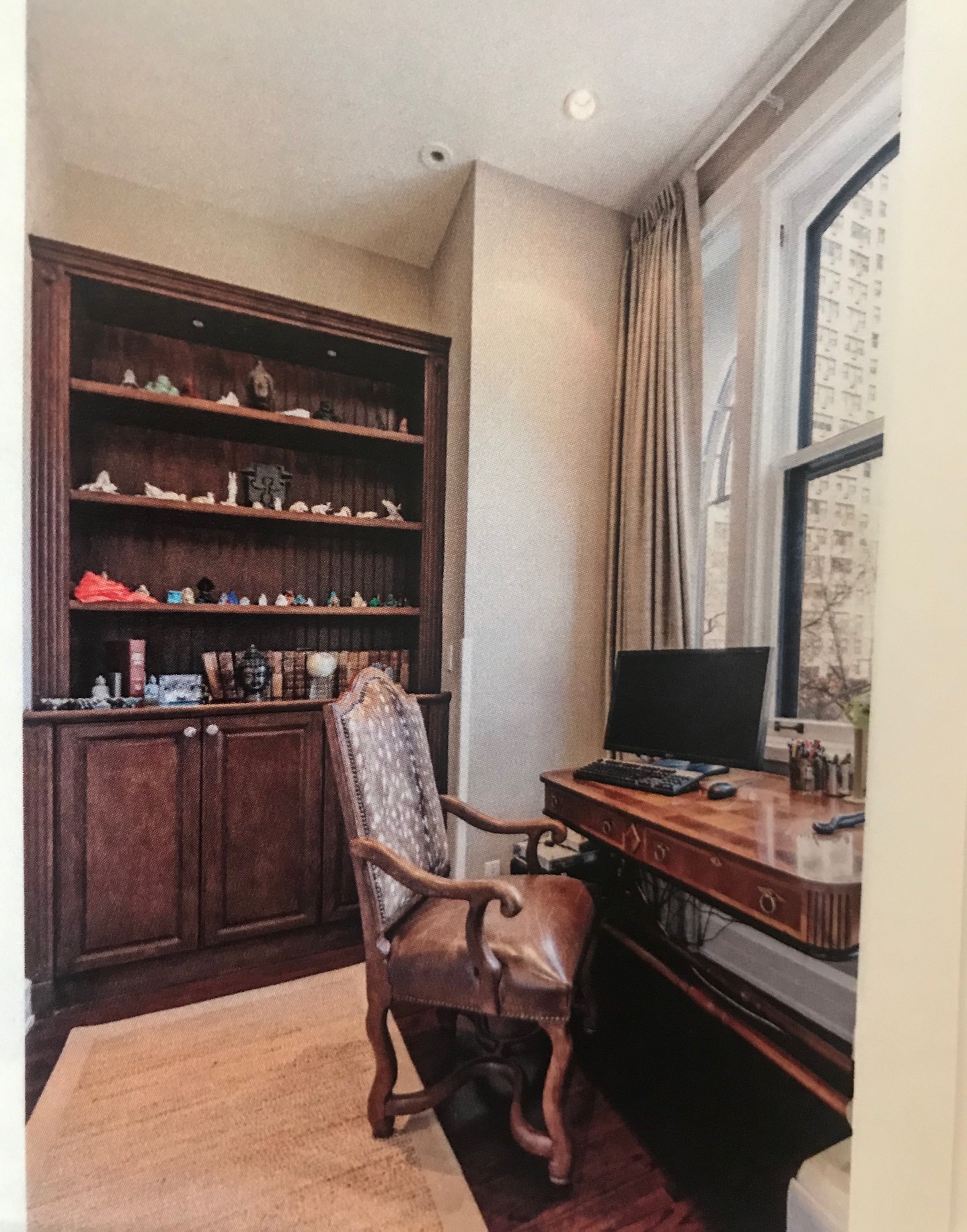

I was single and working two jobs when I bought my first home. I stripped my kitchen cabinets, fixed bathroom wallpaper that was installed upside down and repaired a fence that Mother Nature had blown over. These were unexpected issues I had not planned for in terms of time or budget — they were also life lessons. Once my house was renovated, I was surprised by how often I reset my “to-do” list. Window washing, shoveling, furnace maintenance … all part of homeownership. I’d barely considered ongoing maintenance, in terms of dollars or time spent. Years later, I married a finance guy who said, “You’re good at maintaining everything. I couldn’t do it better. Keep that job!” It’s fun to decorate, renovate and maintain a home, but it’s also a never-ending job. I enjoy the work, but it is work. It’s why I also promote the convenience of the luxury rental lifestyle! — Randy Fifield, chairwoman of Chicago-based Fifield Cos. and founder of Randy Fifield Modern Living

My father is a homebuilder, so I grew up in the industry. The first home I bought was with my wife in 1983. It was a model home in Wheeling built by Lexington Homes. It was in a building of eight units, all with one-car garages and a common entrance, and measured 1,200 square feet with three bedrooms and two baths. I remember wishing we had a basement when the one-car garage got cluttered, and it was rough parking one car outside in winter. We also did not like the noise from living below another unit and being next to the hallway to the garages. Another issue was we had only one, small window in the master bedroom. We only stayed for two years, then moved to a single-family home twice as big in Buffalo Grove. These are things I keep in mind today as a homebuilder when designing homes! — Jeff Benach, principal of Chicago-based Lexington Homes

What do I wish I had known before buying my first place? That applying for a mortgage loan would be the seventh circle of hell. It makes sense. Banks need to ensure you can actually repay this giant loan. But they want to trace the origin of every cent you have, and they want paper documents — a bit of a challenge since I do everything electronically and, yeah, I don’t have a printer. If you’re getting close to being under contract, start gathering your paper now: paychecks, bank statements, tax returns, other sources of income, the promissory note committing your left kidney to the broker. Lesson learned. I either have to live in this condo forever, or I need to get rich and buy my next place with cash. — Dawn Rhodes, Chicago Tribune reporter